Court rejects excuses for delay, upholds statutory provisions for interest on late refunds under the APVAT Act.

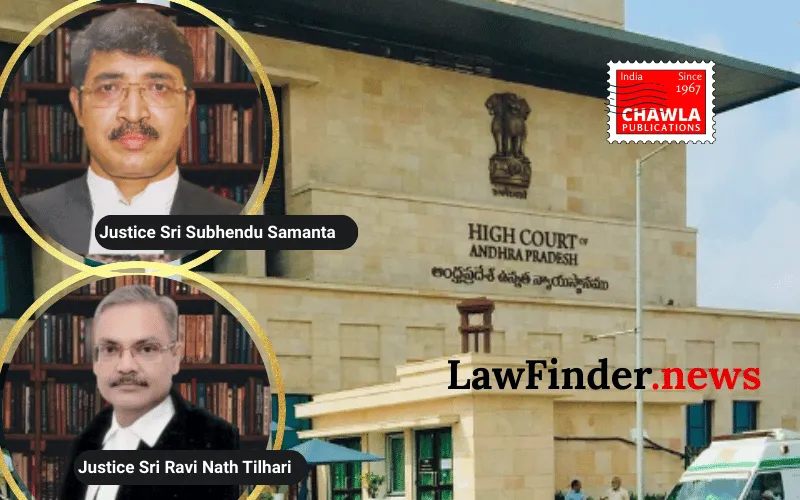

In a significant ruling, the Andhra Pradesh High Court has directed the State of Andhra Pradesh to pay interest on delayed tax refunds as mandated under the Andhra Pradesh Value Added Tax (APVAT) Act, 2005. The judgment, delivered by a Division Bench comprising Justices Ravi Nath Tilhari and Subhendu Samanta, came in response to a writ petition filed by M/s. JBD Educationals Pvt. Ltd., challenging the rejection of their interest claim on a belated refund of Rs. 1,27,34,194.

The crux of the case revolved around the interpretation of statutory provisions regarding refunds under the APVAT Act. The petitioner argued that despite the refund order being passed within the statutory period of 90 days, the actual payment was delayed until March 31, 2022, thereby entitling them to interest. The High Court concurred, stating that the mere passing of the refund order does not constitute compliance unless the refund amount is actually paid within the stipulated period.

The court highlighted that the statutory language is unambiguous in requiring "actual refund" within 90 days, and any delay beyond this period attracts interest at the rate of 1.25% per month, as outlined in Rule 35(8)(c) of the APVAT Rules, 2005. The bench emphasized that the statute does not permit excuses for non-payment within the prescribed period, and any issues like CFMS (RBI) delays or administrative challenges cannot exempt the liability for interest.

The judgment further clarified that the extension of limitation periods due to the COVID-19 pandemic, as ruled by the Supreme Court in suo motu WP(C) No.03/2020, does not apply to refund claims under the APVAT Act. Thus, the statutory period for refunds remains unaltered, reinforcing the obligation to adhere strictly to the prescribed timelines.

This ruling reinforces the principle that statutory provisions must be interpreted based on their plain language, especially in taxing statutes where equitable considerations do not apply. The decision also sets a precedent that administrative inefficiencies or external factors cannot justify deviations from statutory mandates regarding refunds.

In conclusion, the High Court allowed the writ petition and issued a writ of mandamus, directing the respondents to pay interest on the delayed refund from the expiry of the 90-day period till the date of actual payment. This judgment serves as a reminder of the judiciary's role in upholding statutory obligations and ensuring fairness in administrative processes.

Bottom Line:

Taxation - Claim for interest on belated refund under Andhra Pradesh Value Added Tax (APVAT) Act - Liability to pay interest arises if refund is not actually made within the statutory period of 90 days, despite the order of refund being passed within the stipulated time.

Statutory provision(s): Section 38 of the Andhra Pradesh Value Added Tax (APVAT) Act, 2005; Rule 35(8)(c) of the Andhra Pradesh Value Added Tax (APVAT) Rules, 2005.