Court Upholds Bank's Commercial Discretion in Loan Recovery Amid Lack of Policy Mandating OTS Disclosure

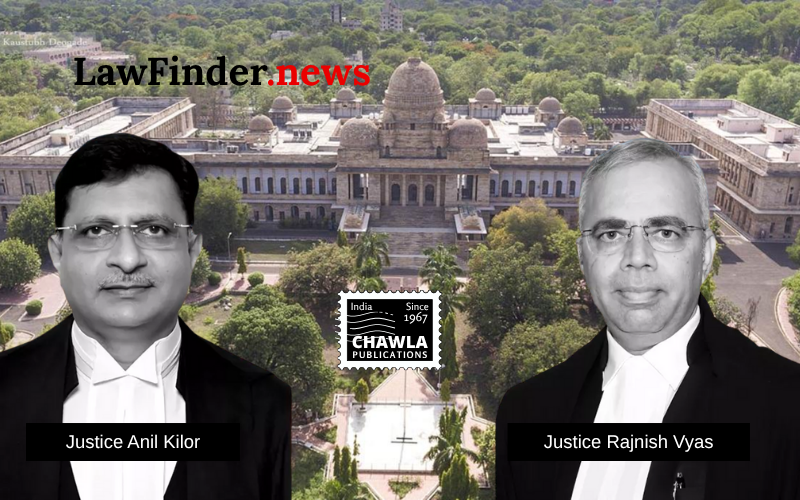

In a significant ruling, the Bombay High Court's Nagpur Bench, comprising Justices Anil S. Kilor and Rajnish R. Vyas, dismissed a writ petition filed by Ms. Archana Wani against Indian Bank, formerly Allahabad Bank, concerning the acceptance and disclosure of One Time Settlement (OTS) benchmarks. The court held that banks cannot be compelled by a writ of mandamus under Article 226 of the Constitution to disclose benchmarks for OTS proposals or accept such proposals in the absence of any specific policy or guidelines necessitating such disclosures.

The case revolved around Ms. Wani's challenge against the bank's refusal to accept OTS proposals aimed at settling outstanding loan amounts. The petitioner argued that the bank had acted akin to a private money lender, failing to disclose the benchmarks for assessing OTS proposals, thereby rejecting them unfairly.

The court underscored the importance of commercial wisdom in banking operations, emphasizing that banks deal with public money and must act in the public interest. The judgment highlighted that the bank's refusal to disclose benchmarks or accept OTS proposals was justified, as no policy or guidelines mandated such actions. The court discouraged judicial interference in banking matters, particularly when recovery of the full loan amount could be achieved through auctioning mortgaged properties.

Furthermore, the court dismissed the invocation of the doctrine of legitimate expectation by the petitioner, stating that such a doctrine cannot compel banks to grant OTS benefits without existing policies, guidelines, or express promises. The judgment reiterated that courts cannot rewrite contract terms or modify agreements under Article 226.

The ruling aligns with the Supreme Court's precedents, which affirm the discretionary power of banks in granting OTS benefits, emphasizing that such decisions should be left to the bank's commercial judgment. The judgment also noted that the petitioner failed to produce any specific policy regarding OTS schemes.

In conclusion, the court upheld the bank's decision to reject the OTS proposal, affirming that the powers of judicial review under Article 226 cannot be exercised to compel banks against their commercial discretion. The petition was dismissed, allowing the bank to proceed with recovery actions under the SARFAESI Act and the Insolvency and Bankruptcy Code, 2016.

Statutory provision(s):

- - Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 - Section 13(2), Section 13(4)

- - Insolvency and Bankruptcy Code, 2016 - Section 7

- - Constitution of India - Article 226