Court rules against the Revenue, emphasizing the necessity for a mindful approval process in tax proceedings.

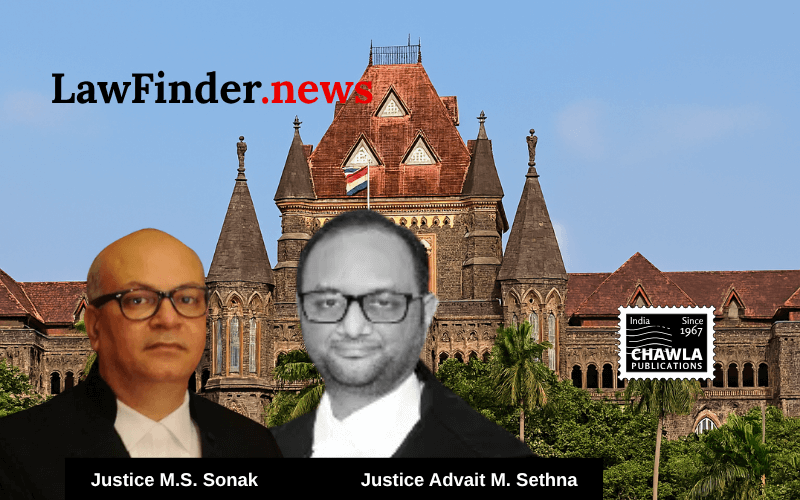

In a significant judgment, the Bombay High Court has dismissed an appeal by the Principal Commissioner of Income Tax-1 against Vrushali Sanjay Shinde, underscoring the importance of a thorough application of mind in the approval process under Sections 153C and 153D of the Income Tax Act, 1961. The division bench comprising Justices M.S. Sonak and Advait M. Sethna delivered the verdict on December 10, 2025, maintaining the decision of the Income Tax Appellate Tribunal (ITAT).

The case revolved around the validity of an approval dated August 6, 2010, granted by the Additional Commissioner of Income Tax, Central Range, Thane, for initiating proceedings under Section 153C. The ITAT had previously held that the approval was granted mechanically, without reflecting a minimum application of mind, rendering the subsequent proceedings incompetent. This decision was challenged by the Revenue, arguing that the approval was based on substantial material, including a raid, a special audit, and recorded statements of the assessee.

However, the High Court upheld the ITAT's findings, stating that while an approval order need not be as detailed as a reasoned judgment, it must demonstrate at least a basic application of mind. The Court emphasized that mere affidavits claiming the existence of material for approval cannot rectify an inherently flawed process. The judgment cited the Court's previous decision in the case of Principal Commissioner of Income Tax Central 4 v. Citron Infraprojects Limited, where similar issues were addressed, and the Supreme Court had dismissed the Special Leave Petitions.

The Court's decision is seen as a reaffirmation of the legal principle that procedural rigor cannot be compromised in tax matters. By ruling in favor of the assessee, the Court has set a precedent, reinforcing the necessity for tax authorities to ensure that approvals for proceedings under Section 153C are not granted in a perfunctory manner.

The appeal was dismissed with no order as to costs, delivering a clear message that the integrity of the approval process is paramount in tax litigation.

Bottom Line:

Income Tax Act, 1961 - Section 153C - Approval under Section 153D must reflect application of mind - Mechanical approval without application of mind renders proceedings under Section 153C invalid.

Statutory provision(s): Income Tax Act, 1961 - Section 153C, Section 153D