Court highlights lack of statutory qualification of auditor and procedural lapses in fraud classification under RBI Master Directions

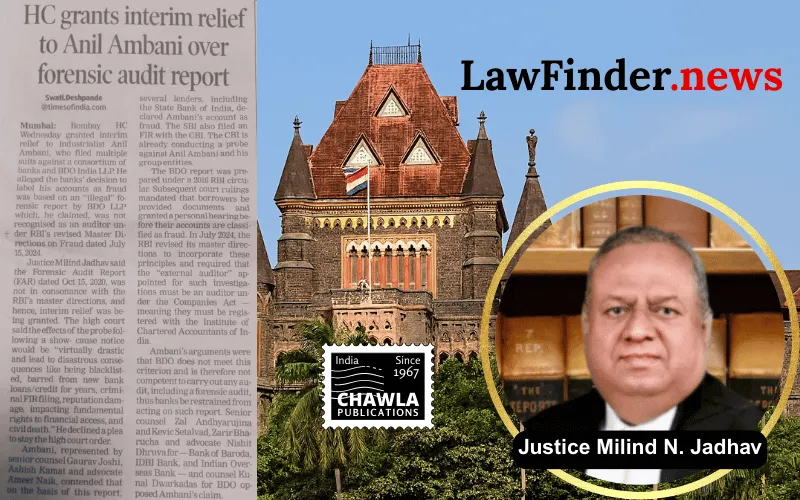

In a significant judgment delivered on December 24, 2025, the Bombay High Court, presided over by Justice Milind N. Jadhav, granted interim relief to Anil D. Ambani, the plaintiff in three related suits against Indian Overseas Bank, IDBI Bank, Bank of Baroda, and others. The Court stayed all actions taken by the banks relying on a Forensic Audit Report (FAR) dated October 15, 2020, prepared by BDO LLP, and the subsequent Show Cause Notices issued by the banks.

The dispute arose from the classification of accounts of Reliance Communications Limited (RCOM) and its group companies as fraud accounts by the banks, based on the FAR prepared by BDO LLP. Anil D. Ambani, who was the non-executive director of RCOM until 2019, challenged the validity of the FAR and consequential bank actions on the ground that the forensic auditor and the signatory of the report were not qualified under relevant statutory provisions, particularly the Companies Act, 2013, and the Chartered Accountants Act, 1949.

The plaintiff argued that under the new 2024 RBI Master Directions on Fraud Risk Management, the forensic audit must be conducted by an auditor qualified under the "relevant statutes," which include being a Chartered Accountant (CA) registered with the Institute of Chartered Accountants of India (ICAI) and holding a valid certificate of practice. It was established through an RTI application that BDO LLP was not a CA firm, and the sole signatory of the FAR was not a CA, thus allegedly rendering the FAR invalid and the Show Cause Notices untenable.

The banks contended that the FAR was prepared under the 2016 RBI Master Directions, which did not prescribe the requirement of a CA qualification for the forensic auditor. They argued that the 2024 Directions apply prospectively and do not invalidate actions taken under the earlier framework. Further, the banks relied on the empanelment of BDO LLP with the Indian Banks' Association (IBA) and Securities and Exchange Board of India (SEBI) as evidence of auditor eligibility. They also submitted that the plaintiff had knowledge of the FAR and its signatory since 2020 and had not raised these objections in earlier proceedings, thereby waiving the right to challenge.

However, the Court's detailed analysis traversed the statutory provisions, the RBI Master Directions of 2016 and 2024, and relevant Supreme Court precedents. The Court observed that:

- The Companies Act, 2013 (Sections 141 and 145) mandates that auditors appointed for statutory audits must be qualified Chartered Accountants, and only CA partners can sign audit reports.

- The 2024 RBI Master Directions clarify and consolidate the requirements of forensic audit, expressly mandating auditor qualification under relevant statutes, including CA qualification.

- The appointment of BDO LLP as forensic auditor was flawed as it was actively involved as a consultant to the banks prior to its appointment, compromising independence and objectivity.

- The FAR was incomplete, inconclusive, and lacked critical supporting documentation, including the absence of Unique Document Identification Number (UDIN) and statutory audit standards application.

- The banks failed to adhere to the timelines prescribed under the RBI Master Directions, with the forensic audit report submitted well beyond the stipulated period.

- The plaintiff was not given full disclosure of the FAR and annexures in a timely manner, impeding the ability to respond effectively to the Show Cause Notices.

- The legal doctrine of prospective application was applied to the 2024 RBI Master Directions, but the clarificatory nature of the footnote regarding auditor qualification implies the requirement was implicit even under the 2016 Directions.

The Court concluded that the FAR, being the foundation of the Show Cause Notices and subsequent fraud classification, was legally infirm due to the auditor's lack of statutory qualification and procedural irregularities. Granting interim relief, the Court stayed all actions based on the FAR and Show Cause Notices pending final adjudication. The Court declined the banks' request for a stay of the judgment, emphasizing the importance of upholding principles of natural justice, fairness, and statutory compliance.

This judgment underscores the necessity for banks to strictly comply with statutory provisions and RBI Master Directions when appointing forensic auditors and initiating fraud proceedings. It also reaffirms the requirement for transparency and due process in fraud classification to prevent arbitrary and prejudicial actions against borrowers.

Bottom Line:

Forensic Audit Report (FAR) relied upon for declaring a borrower as fraud must be prepared and signed by a qualified Chartered Accountant or firm meeting statutory qualifications under relevant statutes; appointment of a forensic auditor lacking such qualifications vitiates the proceedings.

Statutory provision(s): Companies Act, 2013 Sections 141(1), 141(2), 145; Chartered Accountants Act, 1949 Sections 2(b), 2(c), 6; Banking Regulation Act, 1949 Sections 2, 5(o), 35A; Civil Procedure Code, 1908 Order XXXIX Rules 1 & 2, Order II Rule 2; Reserve Bank of India Master Directions on Fraud Risk Management in Commercial Banks 2016 and 2024.

Anil D. Ambani v. Indian Overseas Bank, (Bombay) : Law Finder Doc Id # 2826727