Court rules that prolonged delays in adjudicating tax notices infringe on fairness and justice, dismisses notices issued under Central Excise Act

In a significant ruling, the Bombay High Court, Goa Bench, quashed show cause notices issued to Computer Graphics Private Limited by the Central Excise authorities, citing gross delays in adjudication. The court held that the delay of 8-9 years in adjudicating these notices, despite no statutory limitation period being prescribed, was unreasonable and prejudicial to the assessee.

The case involved two writ petitions filed by Computer Graphics Private Limited, challenging the delayed adjudication of show cause notices issued in 2016 and 2017, covering periods dating back to 2010. The notices were concerned with alleged contraventions of provisions under the Central Excise Act, 1944, and the Central Excise Rules, 2002, relating to the inclusion of transaction values for VAT/CST and CENVAT credit claims.

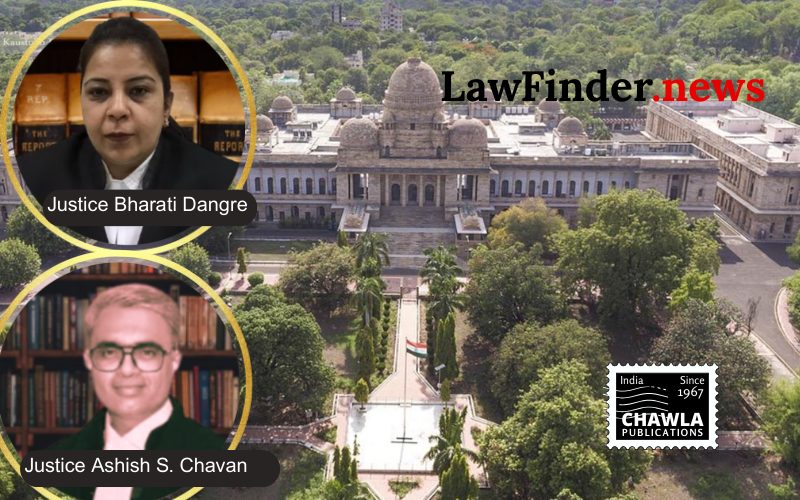

The Bench, comprising Justices Bharati Dangre and Ashish S. Chavan, emphasized the necessity for timely adjudication of such notices. The court ruled that the Revenue must act expeditiously in the public interest, and long delays without valid reasons could not be justified by mere placement of cases in the Call Book pending higher judicial decisions.

The court relied on precedents set by previous cases, notably "Sanghvi Reconditioners Pvt. Ltd. v. Union of India" and "ATA Freight Line India Pvt. Ltd. v. Union of India," where similar delays were held to be contrary to principles of fairness and justice. The court noted that prolonged delays compromised the ability of the assessee to defend against the allegations effectively, as it would be challenging to gather evidence and records after such a long time.

The judgment also criticized the Revenue's practice of indefinitely keeping cases in the Call Book, stressing that periodic reviews and prompt actions post-resolution of related higher judicial matters are essential.

Ultimately, the court declared the show cause notices null and void due to the unreasonable delay, providing a crucial precedent for similar cases where adjudication has been unduly deferred.

Bottom Line:

Show cause notices issued under Central Excise Act cannot be adjudicated after an unreasonable and gross delay, even if no specific limitation period is prescribed for adjudication. The delay may cause prejudice to the assessee and defeat the purpose of adjudication.

Statutory provision(s): Central Excise Act, 1944 Section 4(3)(d), Central Excise Rules, 2002 Rule 6, CENVAT Credit Rules, 2004 Rule 3