Court Quashes Show Cause Notice Against Aerocom Cushions, Following Gujarat High Court Precedent

In a significant ruling, the Bombay High Court's Nagpur Bench has held that the assignment of leasehold rights for a plot of land with a building does not constitute a supply of services under the Central Goods and Services Tax (CGST) Act, 2017, thereby exempting it from GST liability. The decision came in response to a writ petition filed by Aerocom Cushions Private Limited challenging a show cause notice issued by the Assistant Commissioner (Anti-Evasion).

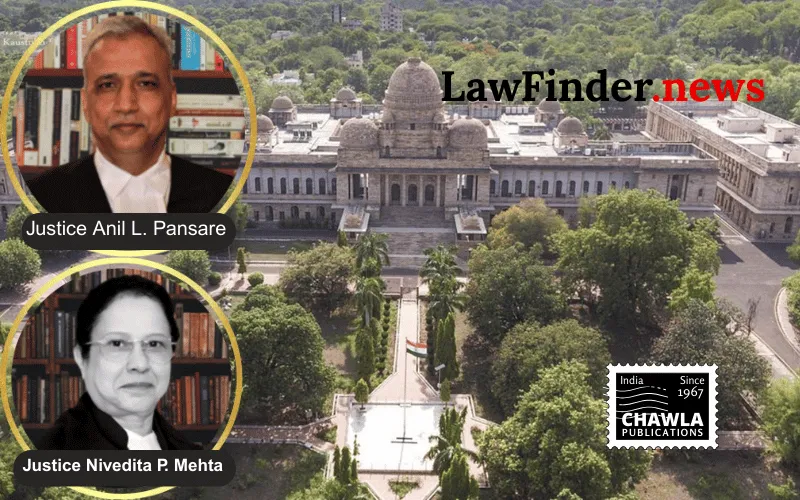

The bench, comprising Mr. Anil L. Pansare and Ms. Nivedita P. Mehta, referred to a Gujarat High Court judgment, underscoring its binding nature in the absence of a contrary ruling by another competent court. Aerocom Cushions had received a notice demanding a GST payment of Rs. 27,00,000 for the transfer of leasehold rights to M/s. Rishita Industries, a transaction the authorities deemed as a supply of services. However, the Bombay High Court ruled that such a transfer is a sale/transfer of benefits arising out of immovable property and does not attract GST.

The judgment highlighted that the petitioner’s transaction involved the transfer of leasehold rights, which does not amount to a lease or sub-lease. The court noted that the transaction pertains to the transfer of benefits from an immovable property, with no nexus to the petitioner’s business activities, thus lacking the essential elements of a supply of service.

The court's decision follows the precedent set by the Gujarat High Court, which held that similar transactions were not subject to GST under Section 9 of the CGST Act. The notification No. 12/2017-Central Tax (Rate) further exempts one-time upfront amounts for long-term leases of industrial plots from GST.

In conclusion, the Bombay High Court quashed the show cause notice against Aerocom Cushions, reiterating that such transfers of leasehold rights do not constitute a taxable supply of services under the current GST framework.

Bottom Line:

Assignment of leasehold rights of a plot of land along with the building thereon does not constitute a supply of services under GST Act and is not liable to GST.

Statutory provision(s): Central Goods and Services Tax Act, 2017, Section 7(1), Clause 2(b) of Schedule II, Section 9, Notification No. 12/2017-Central Tax (Rate)