HDFC Ergo's appeal against a compensation award for 100% disability in a motor accident case dismissed; Tribunal's findings on negligence upheld.

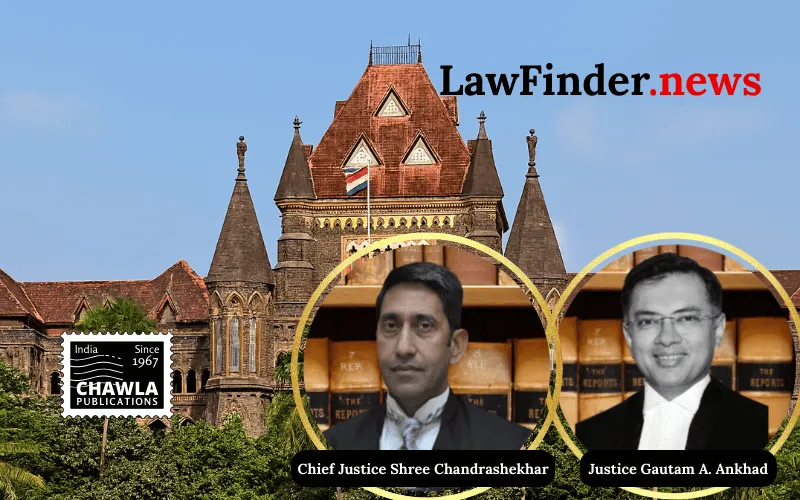

In a significant judgment, the Bombay High Court dismissed the appeal filed by HDFC Ergo General Insurance Co. Ltd., upholding the Motor Accident Claims Tribunal's decision to award substantial compensation to Adil Lutfi Peters, a victim of a motor accident. The division bench comprising Chief Justice Shree Chandrashekhar and Justice Gautam A. Ankhad reinforced the Tribunal's findings on negligence and compensation entitlement, marking a decisive moment in motor accident compensation claims.

The case revolved around a road accident on November 18, 2014, where Adil Lutfi Peters, then 53 and employed as cabin crew with Air India, sustained 100% permanent disability due to a collision with a speeding car. The Tribunal had previously awarded Peters compensation of Rs. 2,97,89,800 with an interest rate of 7% per annum, a decision contested by the insurance company under Section 173 of the Motor Vehicles Act, 1988.

The Tribunal's decision was heavily supported by evidence, including an FIR, charge-sheet, and witness testimonies, which demonstrated the negligence of the car driver and the absence of any contributory negligence on the part of Peters. The Insurance Company's claims of non-joinder of necessary parties and invalid driving license were also dismissed.

HDFC Ergo's appeal primarily questioned the Tribunal's findings on negligence, highlighting an alleged contradiction in the victim's statement. However, the High Court found no substantial question of law or significant factual contradictions that could undermine the Tribunal's judgment. The Court emphasized that minor inconsistencies in witness statements do not materially affect the judgment unless they disrupt its foundation.

Additionally, the Court noted that the compensation proceedings under the Motor Vehicles Act are summary in nature, focusing on determining a fair compensation based on a preponderance of probabilities rather than strict legal formalities. The Tribunal's holistic view and adherence to established legal guidelines in determining the compensation were commended.

The High Court also ordered HDFC Ergo to pay an additional Rs. 2,00,000 as litigation costs to Peters, emphasizing the finality of the Tribunal's decision. The company’s request for a stay was declined, noting the absence of any substantial legal questions in the appeal.

This judgment underscores the judiciary's commitment to uphold fair compensation for accident victims and the strict scrutiny applied to appeals challenging Tribunal decisions. It serves as a precedent for future cases involving motor accident compensation claims, highlighting the importance of comprehensive evidence and the limited scope for overturning Tribunal findings on factual grounds.

Bottom Line:

Motor Vehicles Act - Tribunal's finding on negligence upheld - Victim awarded compensation for permanent disability due to motor accident - Insurance Company's appeal dismissed.

Statutory provision(s): Motor Vehicles Act, 1988 Section 173, Motor Vehicles Act, 1988 Section 166, Evidence Act.