Court Relies on Income Tax Returns to Determine Deceased's Income, Raising Compensation to Rs. 39 Lakh

In a significant judgment by the Calcutta High Court, the compensation awarded to the family of a deceased goldsmith in a motor accident case was substantially increased from Rs. 15.05 lakh to Rs. 39 lakh. The court ruled that income tax returns filed during the lifetime of the deceased should be considered reliable for determining income in such claims, dismissing the need for corroborative evidence like bank passbooks.

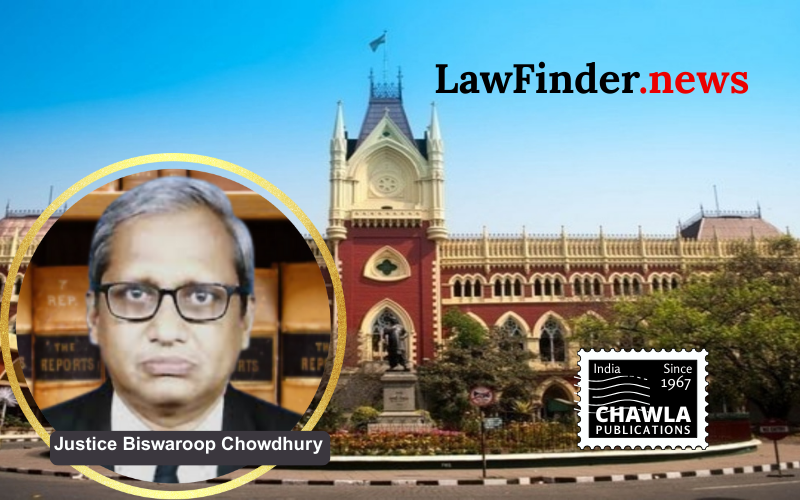

The case, titled Sandhya Rani Jana v. ICICI Lombard General Insurance Co. Ltd., was presided over by Justice Biswaroop Chowdhury. The appellants, the parents of the deceased, argued that the trial court had erred by not considering the income tax returns which showed an annual income of Rs. 3,18,470. Instead, the trial court assessed the income at Rs. 10,000 per month, leading to a lesser compensation.

The High Court emphasized the validity of income tax returns as authentic documents once verified by the income tax authorities. It overturned the trial court’s insistence on additional financial documents and upheld the tax returns as the basis for income assessment.

Applying a multiplier of 17, appropriate for the age of the deceased who was 27 years old, and considering future prospects, the High Court calculated the total compensation to be Rs. 39 lakh. This amount includes additional sums for loss of estate, funeral expenses, and filial consortium.

The court directed ICICI Lombard General Insurance Co. Ltd., the insurer of the offending vehicle, to pay the revised compensation with interest at 6% per annum from the date of filing the claim case.

This decision aligns with precedents set by higher courts, emphasizing the importance of income tax returns in determining compensation in accident claims. The judgment serves as a crucial reference for similar cases, reinforcing the notion that statutory documents like income tax returns hold significant weight in legal proceedings concerning financial assessments.

Bottom Line:

Motor Vehicle Accident Compensation - Income tax returns filed during the lifetime of the deceased are reliable documents for determining income for compensation purposes.

Statutory provision(s): Motor Vehicles Act, 1988 Section 166