Intimation of cancellation of policy must be established

The Bombay High Court (Aurangabad Bench) in the case of New India Assurance Company Limited v. Ganesh has significant implications for how insurance companies handle motor accident claims, particularly when it comes to the cancellation of policies due to dishonoured premium payments. This case serves as a vital reference point for understanding the liabilities of insurance companies and the rights of policyholders in such scenarios.

Background of the Case

The dispute arose from a motor accident claim filed by the respondents, whose family member, Shamalbai, was fatally injured by a tempo vehicle. The claimants sought compensation, asserting that Shamalbai was the breadwinner of the family. The Motor Accident Claims Tribunal awarded compensation, holding both the tempo owner and the insurance company liable.

Key Issues Addressed

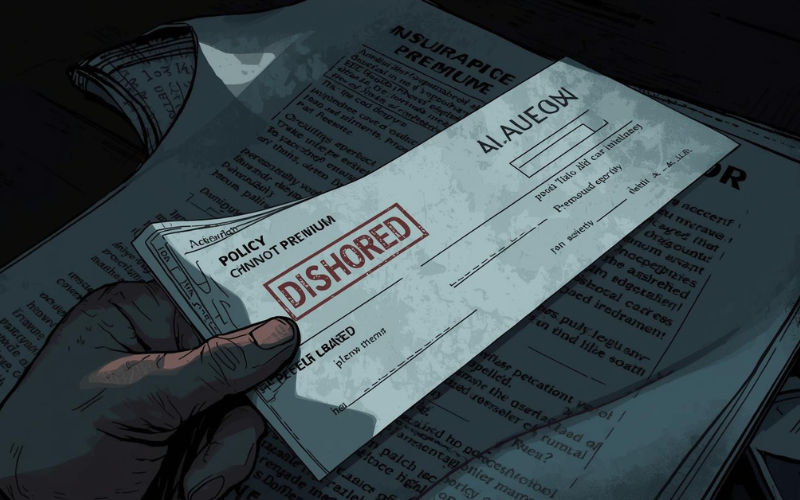

1. Insurance Policy Cancellation Due to Cheque Dishonour: The insurance company argued that the policy was effectively cancelled because the premium cheque was dishonoured. They claimed to have sent cancellation notices to the policyholder and relevant authorities, asserting that the company was not liable to cover the accident due to this cancellation.

2. Evidence of Cancellation Intimation: The court scrutinized the insurance company's claim regarding the cancellation notice. It highlighted the insufficiency of evidence provided by the insurer, particularly the lack of acknowledgment receipts proving that the policyholder received the cancellation notice.

Court's Findings

The High Court, led by Justice Abhay S. Waghwase, examined the evidence presented. The insurance company failed to establish that the policyholder received a cancellation intimation. The court noted discrepancies, such as the absence of complete postal details and acknowledgment receipts. This weakened the insurer's defence and led to the conclusion that the insurance policy was still in force at the time of the accident.

Significance of Cash Payment Claims

The tempo owner contended that the premium was paid in cash through an agent, which further complicated the insurance company's position. The court found no substantive denial from the insurance company regarding cash payments, and thus held the insurer liable to compensate the claimants.

Impact on Insurance Practices

This judgment sets a precedent emphasizing the need for insurance companies to maintain rigorous documentation and communication practices. It underscores the importance of transparency and accountability in policy cancellations and highlights the judiciary's role in protecting policyholder rights against technical defenses that may be employed by insurers.

Conclusion

The Bombay High Court's decision in this case reinforces the principle that insurance companies cannot evade liability through procedural lapses or inadequate evidence of policy cancellations. It serves as a crucial reminder for insurers to ensure thorough and traceable communication with policyholders regarding any changes in policy status. For policy holders, it underscores the importance of understanding their rights and the necessity of maintaining accurate records of premium payments.

This judgment not only clarifies the legal stance on insurance liability in motor accident claims but also contributes to a broader understanding of consumer protection within the insurance sector. As we navigate similar cases in the future, this decision will undoubtedly serve as a guiding framework for both legal professionals and insurance companies alike.

New India Assurance Company Limited v. Ganesh, (Bombay) : Law Finder Doc id # 2761440