Interim relief granted amid challenge to Assam's Tax Reimbursement Scheme; Clause 8 under scrutiny for constitutional conflict.

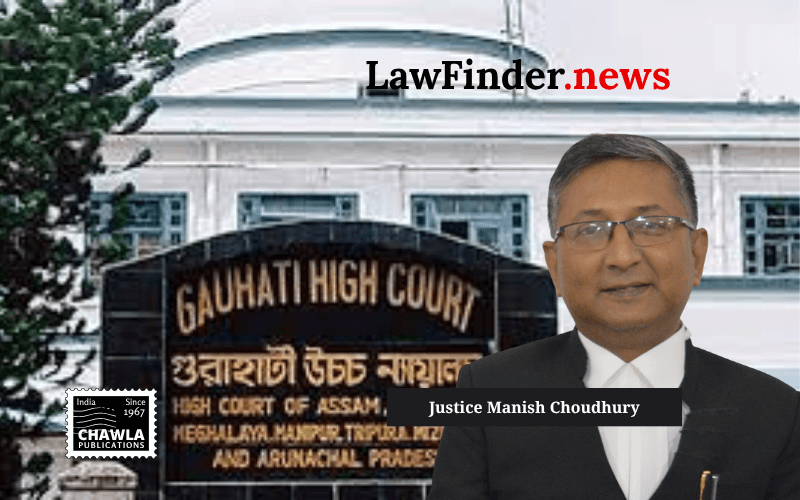

In a significant development, the Gauhati High Court has temporarily suspended the operation of Show Cause Notices issued to Patanjali Foods Limited under the Assam Industries [Tax Reimbursement for Eligible Units] Scheme, 2017. The notices, dated September 22, 2025, questioned the company's eligibility for Input Tax Credit (ITC) under the scheme. The interim order was passed by Justice Manish Choudhury on November 14, 2025.

Patanjali Foods, a public limited company operating in the fast-moving consumer goods sector, had challenged the Show Cause Notices issued under Sections 73 and 74A of the State Goods and Services Tax (SGST) Act, 2017. The notices alleged that Patanjali Foods availed ITC despite being ineligible under Clause 8 of the Reimbursement Scheme, which denies ITC on inter-State supplies.

Senior Counsel Mr. Arvind P. Datar, representing Patanjali Foods, argued that Clause 8 of the Reimbursement Scheme contradicts Articles 246A and 279A of the Constitution of India as well as provisions of the Central Goods and Services Tax (CGST) Act, 2017. Mr. Datar emphasized that such a denial of ITC exceeds the jurisdiction granted by these constitutional and statutory provisions.

The State, represented by Mr. B. Choudhury, contended that the petitioner should first respond to the Show Cause Notices before seeking relief from the court. The State further argued that the petitioner has the option to appeal any adverse decisions under Section 107 of the CGST or SGST Act.

The court, upon reviewing the constitutional and statutory provisions, found prima facie merit in the arguments presented by Patanjali Foods. Justice Choudhury noted that Clause 8 appears to run contrary to the established legal framework. As a result, the court ordered the suspension of the Show Cause Notices until the next hearing, scheduled for December 15, 2025.

The State has been directed to file a counter affidavit before the returnable date, with a copy to be provided to the petitioner's counsel. This case will be closely watched as it addresses significant issues regarding the interplay between state tax schemes and national GST provisions.

Bottom Line:

The operation of Show Cause Notices issued under the State Goods and Services Tax Act, 2017, is suspended in the interim, as the provisions of the Assam Industries [Tax Reimbursement for Eligible Units] Scheme, 2017, prima facie appear to conflict with the Constitution of India and the CGST Act.

Statutory provision(s): Article 246A, Article 279A, Section 73 of SGST Act, Section 74A of SGST Act, Section 16 of CGST Act, Section 164 of CGST Act, Section 2(87) of CGST Act.

Patanjali Foods Limited v. State of Assam, (Gauhati) : Law Finder Doc Id # 2822484