The court clarifies the independent functioning of Sections 129 and 130 under the CGST Act, emphasizing that confiscation can proceed if tax evasion is evident.

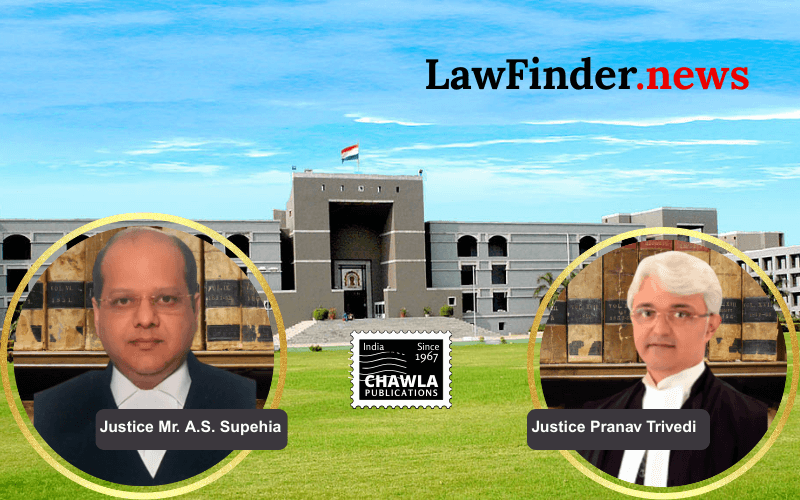

In a significant judgment, the Gujarat High Court addressed the complexities surrounding the detention, seizure, and confiscation of goods under the Central Goods and Services Tax Act, 2017 (CGST Act). The ruling, delivered on December 11, 2025, by a division bench comprising Justices A.S. Supehia and Pranav Trivedi, focused on the independent and mutually exclusive nature of Sections 129 and 130 of the CGST Act.

The case arose from grievances filed by M/s Panchhi Traders and other petitioners against the actions of the State of Gujarat, which involved the detention and subsequent confiscation of goods during transit. The petitioners argued that the authorities improperly invoked Section 130 for confiscation while proceedings under Section 129 were still in progress.

The court elaborated that Sections 129 and 130, after amendments effective from January 1, 2022, operate independently. Section 129 handles the detention and release of goods in transit, while Section 130 addresses the confiscation of goods or conveyances if tax evasion is evident. The court emphasized that the deletion of the non-obstante clause from Section 130 and its retention in Section 129 does not affect their independent operation.

The judgment clarified that the authorities could initiate confiscation under Section 130 during transit if there is a clear intent to evade tax, without needing to complete the process under Section 129. It highlighted that the proper officer must form an opinion on tax evasion based on documents and circumstances at the time of interception. The court also stressed that the actions must be well-founded and proportionate, with misuse attracting judicial scrutiny.

The ruling has significant implications for the enforcement of GST laws, ensuring that procedural violations are handled under Section 129, while substantive violations with tax evasion intent are addressed under Section 130. The court's decision aims to balance compliance with procedural safeguards and the need for stringent measures against tax evasion.

Bottom Line:

Goods and Services Tax (GST) - Sections 129 and 130 of the CGST Act, 2017, are mutually exclusive and independent provisions dealing with detention/seizure and confiscation of goods and conveyance respectively. Confiscation proceedings can be initiated under Section 130 if there is intent to evade tax established, even during transit, without completing the process under Section 129.

Statutory provision(s): Central Goods and Services Tax Act, 2017 - Sections 129, 130; Central Goods and Services Tax Rules, 2017 - Rules 138B, 138C

M/s Panchhi Traders v. State of Gujarat, (Gujarat)(DB) : Law Finder Doc Id # 2822043