Telangana High Court Allows Reopening of Tax Assessment Despite CIRP Resolution

In a significant judgment, the Telangana High Court has ruled that the Corporate Insolvency Resolution Process (CIRP) under the Insolvency and Bankruptcy Code, 2016 does not preclude the Income Tax authorities from reopening assessments under Section 148 of the Income Tax Act, 1961, even after the resolution plan's approval by the National Company Law Tribunal (NCLT). The court dismissed the writ petitions filed by VRDV Traders Private Limited challenging the reopening of their tax assessments for the assessment years 2014-15, 2015-16, and 2016-17.

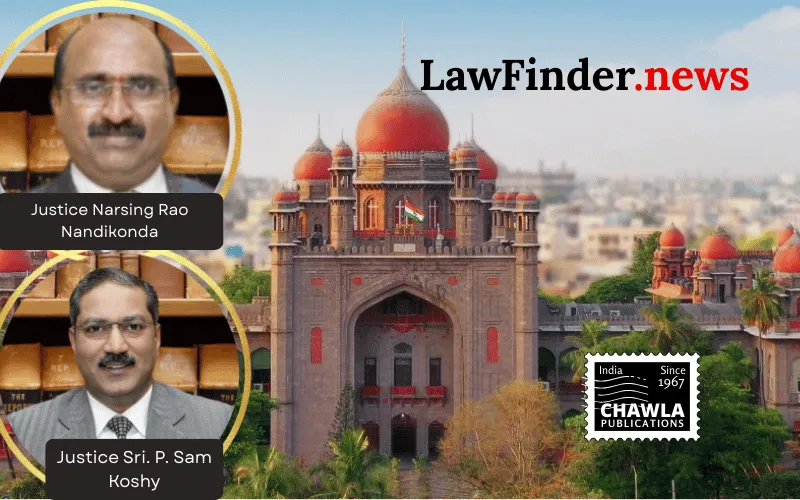

The bench comprising Justices Sri P. Sam Koshy and Sri Narsing Rao Nandikonda delivered the judgment on June 19, 2025, emphasizing the necessity of scrutinizing transactions for potential tax evasion despite the CIRP completion. The Income Tax Department's action stemmed from suspicious transactions involving shell companies and reverse trading, which appeared to have been carried out with the intent of tax evasion.

The petitioner, VRDV Traders, argued that the resolution plan approved by the NCLT extinguishes all liabilities, including those owed to the Income Tax Department. However, the court noted that the reopening of assessments is permissible under law, even post-CIRP, to investigate fraudulent or illegal transactions.

The judgment referenced similar cases, including Dishnet Wireless Ltd. v. Assistant Commissioner of Income-tax and Ghanshyam Mishra and Sons Private Limited v. Edelweiss Asset Reconstruction Company Limited, asserting that the provisions of the Insolvency and Bankruptcy Code cannot impede the Income Tax Department's rights under the Income Tax Act.

The court clarified that while recovery proceedings are unsustainable post-CIRP resolution plan approval, reassessment of tax liabilities can be pursued to ensure compliance and accountability. This ruling underscores the judiciary's commitment to preventing the misuse of CIRP to evade tax obligations through dubious transactions.

The dismissal of the writ petitions allows the Income Tax Department to continue its investigation into the alleged fraudulent activities of VRDV Traders, ensuring that any discovered illegalities are appropriately addressed. The judgment highlights the balance between insolvency resolutions and tax law enforcement, ensuring that tax evasion does not escape scrutiny under the guise of insolvency proceedings.

VRDV Traders Private Limited v. Union of India, (Telangana)(DB) : Law Finder Doc Id # 2767360