The Court rules that South Indian Bank acted within the statutory framework, reinforcing special provisions for senior citizens under the Income Tax Act.

In a significant ruling, the Kerala High Court has upheld the decision of South Indian Bank Limited not to deduct tax at source (TDS) on interest payments to senior citizens who have submitted Form 15H declarations. The appeals, filed by South Indian Bank, challenged the Income Tax Appellate Tribunal's decision which had previously deemed the bank as an "assessee in default."

The case revolved around the interpretation of Section 197A(1C) of the Income Tax Act, 1961, which provides that no tax deduction at source is required for senior citizens who submit a declaration that their estimated total income would be nil. The controversy arose when the Income Tax Department contended that the bank should not have accepted the declarations if the interest income exceeded the basic exemption limit, as suggested by Foot Note No.10 of Form 15H.

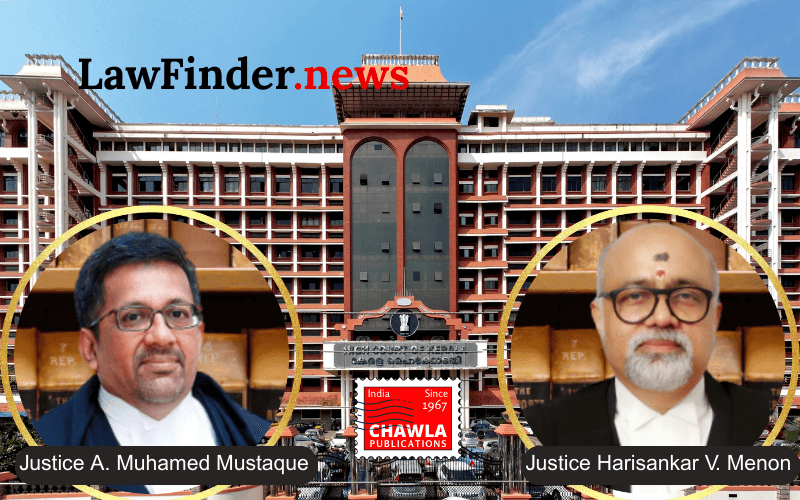

The division bench comprising Justices A. Muhamed Mustaque and Harisankar V. Menon ruled in favor of the bank, stating that the non-deduction of TDS for senior citizens is a welfare measure specifically intended by the legislature. The court observed that the exception under Section 197A(1B), which requires TDS if the income exceeds the basic exemption limit, does not apply to Section 197A(1C).

Furthermore, the court noted that imposing the requirement of verifying income against the basic exemption limit as per Foot Note No.10 would place an impractical burden on the bank. This could potentially defeat the objective of the beneficial treatment extended to senior citizens.

The judgment emphasized that the legislative intent was clear in distinguishing the provisions for senior citizens, and the memorandum explaining the Finance Act, 2003, explicitly mentioned that the prohibition under Section 197A(1B) does not apply to senior citizens.

The ruling is expected to have significant implications for financial institutions and senior citizens, ensuring that the latter can continue to benefit from the special provisions without undue procedural burdens.

Bottom Line:

Income Tax - Non-deduction of TDS under Section 197A(1C) - Senior citizens furnishing Form 15H declarations - Appellant bank not liable to deduct TDS even when the interest paid exceeds the basic exemption limit, as the exception under Section 197A(1B) does not extend to Section 197A(1C).

Statutory provision(s): Income Tax Act, 1961 Section 197A(1C), Section 197A(1B), Section 194A, Section 201, Form 15H.

South Indian Bank Limited v. Income Tax Officer, TDS, (Kerala)(DB) : Law Finder Doc Id # 2822048