Full Bench Ruling Declares Upkeep Costs Deductible Under Income Tax Act, Overturning Previous Tribunal Decision

In a landmark judgment, the Kerala High Court has ruled that expenditures incurred for the re-plantation and replacement of rubber trees, along with their upkeep, are of a revenue nature, making them eligible for tax deductions under Section 37 of the Income Tax Act, 1961. This decision, rendered on December 1, 2025, came as a relief for the petitioner, Rehabilitation Plantations Limited, a state-owned enterprise focused on rubber plantations.

The case revolved around the entitlement of the petitioner to claim deductions on expenses related to the re-plantation and maintenance of rubber trees. Previously, the Kerala Agricultural Income Appellate Tribunal, basing its decision on a Division Bench judgment, had rejected these claims. However, a subsequent Full Bench review found the earlier Division Bench's ruling to be flawed, concluding that such expenditures are indeed revenue in nature and thus deductible.

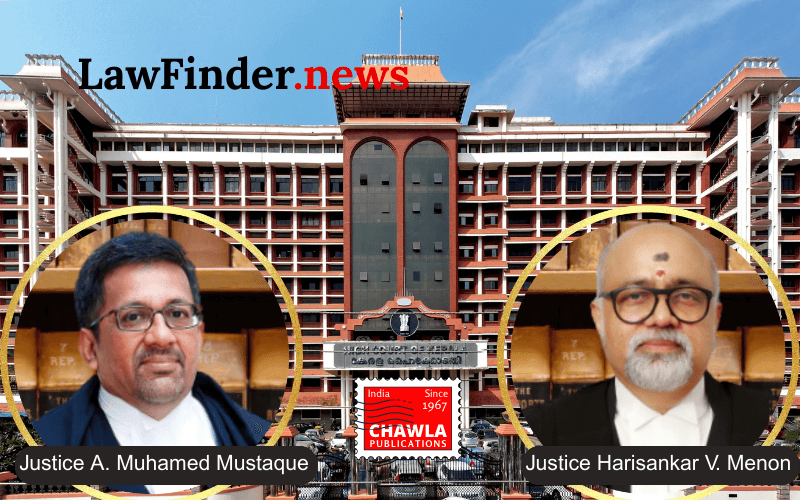

The High Court's Division Bench, comprising Justices A. Muhamed Mustaque and Harisankar V. Menon, highlighted that the Full Bench had rightly overturned the previous judgment. The court recognized the expenditures as necessary for the upkeep and enhancement of the plantation, aligning with Section 37's provisions, which allow for the deduction of revenue expenditures.

The Full Bench had previously clarified that the expenditures on re-plantation and upkeep do not constitute capital expenditure, as they do not lead to the acquisition of a new asset, but rather serve to maintain and enhance the existing income-generating asset, i.e., the rubber plantation.

The decision is expected to have significant implications for agricultural and plantation sectors, setting a precedent for similar cases where the nature of expenses is scrutinized for tax deduction purposes. Legal experts suggest that this ruling could encourage more investments in agricultural maintenance and sustainability, given the tax benefits affirmed by the court.

The High Court's judgment also reflects a broader interpretation of revenue expenditures in the context of agricultural operations, potentially influencing how similar cases are adjudicated in the future.

The court's ruling, favoring the assessee, effectively nullifies the need for further consideration of the second set of appeals, which sought a review of the Tribunal's earlier orders. This marks a decisive victory for Rehabilitation Plantations Limited in its longstanding legal battle over the tax treatment of its plantation maintenance expenses.

Bottom Line:

Expenditure incurred for re-plantation/replacement of rubber trees and their upkeep is revenue in nature and thus eligible for deduction under Section 37 of the Income Tax Act, 1961, as per the Full Bench judgment.

Statutory provision(s): Section 78 of the Kerala Agricultural Income Tax Act, 1991, Section 37 of the Income Tax Act, 1961

Rehabilitation Plantations Limited v. State of Kerala, (Kerala)(DB) : Law Finder Doc Id # 2820033