Supreme Court Enhances Compensation to Rs. 19.09 Lakhs in Motor Accident Claim, Deceased's Annual Income Reassessed; Forward-Looking Compensation Emphasized

In a landmark judgment, the Supreme Court of India has significantly increased the compensation awarded to the claimants in a motor accident case, from Rs. 16.01 lakhs as determined by the Rajasthan High Court to Rs. 19.09 lakhs. The case, Sayar v. Ramkaran, involved the tragic demise of Rajendra Singh Gena, who died in an accident caused by a negligent truck driver in 2006.

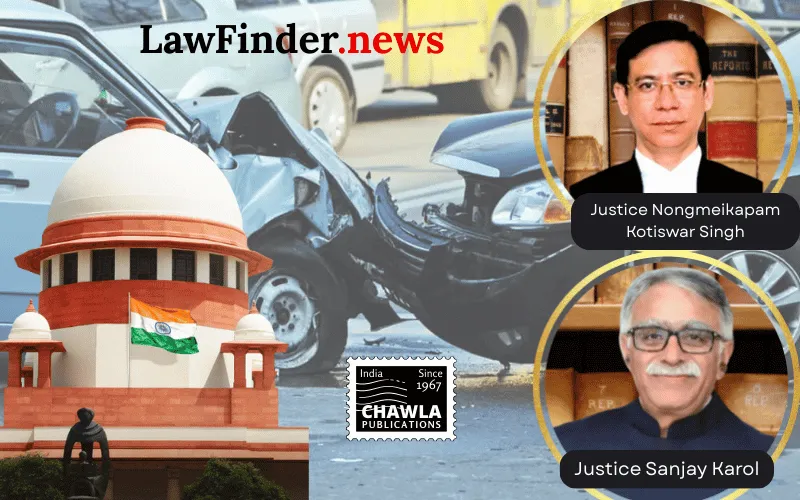

The judgment, delivered by Justices Sanjay Karol and Nongmeikapam Kotiswar Singh, reassessed the annual income of the deceased, taking into account progressive business profits and available evidence, despite the posthumous filing of Income Tax Returns. The Tribunal had earlier assessed the income at Rs. 84,000 per annum based on the 2004-05 tax return, rejecting the subsequent year's return due to discrepancies. However, the Supreme Court recognized the potential growth in the deceased's business, revising the annual income to Rs. 1,00,000.

The judgment also recalculated the compensation under various heads, including future prospects, loss of estate, funeral expenses, and consortium, in accordance with established principles from previous Supreme Court rulings. The Court emphasized the forward-looking nature of compensation under the Motor Vehicles Act, which aims to ensure stability and continuity for lives impacted by accidents.

The case highlighted the importance of considering Income Tax Returns filed after the accident, as per precedents like Nidhi Bhargava v. National Insurance Co. Ltd., allowing them to be scrutinized judicially for assessing compensation.

This decision underscores the Supreme Court's commitment to providing fair and just compensation to victims' families, ensuring their financial security and acknowledging potential future earnings.

Bottom Line:

Motor Vehicles Act, 1988 - Compensation under Section 166 - Assessment of annual income of deceased for compensation - Income Tax Returns filed posthumously can be considered subject to judicial scrutiny and evidence of progressive growth in business profits.

Statutory Provisions: Motor Vehicles Act, 1988 Section 166, Indian Penal Code, 1860 Sections 279, 337, 304A.