Court Overturns Rejection of ST-15 Forms, Affirms No Fault of PSU in Verification

In a significant ruling, the Punjab and Haryana High Court, on December 2, 2025, allowed the petition filed by MMTC Ltd., a Government of India Public Sector Undertaking, against the rejection of its sales tax deduction claims. The court set aside the impugned orders dated June 30, 1999, and May 6, 2005, which had denied MMTC Ltd. the benefits of deductions due to issues with ST-15 forms submitted by its purchasing dealers.

The case revolved around the rejection of ST-15 forms submitted by MMTC Ltd. for the financial year 1993-94. The forms from purchasing dealers, M/s Shree Anand Enterprises and M/s Jagdamba Metals (P) Ltd., were rejected by the Assessing Authority. The rejection was based on the grounds that the registration of M/s Jagdamba Metals (P) Ltd. had expired, and the forms from M/s Shree Anand Enterprises were reported stolen.

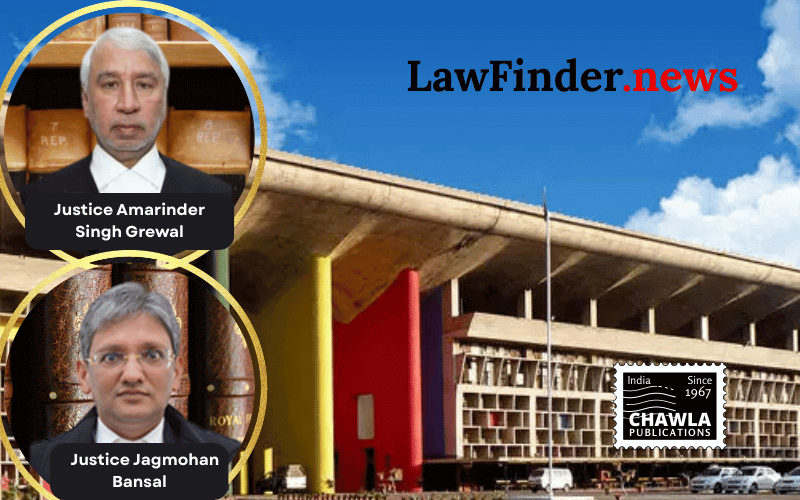

The Tribunal had previously rejected MMTC Ltd.'s appeal, stating that the company should have verified the genuineness of the forms after the theft was reported. However, the High Court, led by Justices Jagmohan Bansal and Amarinder Singh Grewal, disagreed, emphasizing that MMTC Ltd., as a PSU, could not be held responsible for verifying the genuineness of forms or certificates.

The court noted that the Tribunal had allowed similar deductions for the previous assessment year, and the Department had accepted that decision. The court further remarked that there was no statutory provision requiring MMTC Ltd. to verify the genuineness of the certificates, and denying the deduction would amount to punishing the petitioner without fault.

In its judgment, the court highlighted the absence of any allegation or evidence suggesting MMTC Ltd.'s involvement in the theft or that it was aware of the stolen forms. The court concluded that the forms, though stolen, were genuine and duly signed by departmental authorities, with no dispute on the sale of goods.

The ruling aligns with the precedent set in the case of "State of Haryana v. INALSA Ltd." and the Supreme Court's decision in "Godrej Sara Lee Ltd. v. Excise and Taxation Officer-cum-Assessing Authority," underscoring that a decision on one assessment year applies to others if circumstances remain unchanged.

The judgment marks a significant win for MMTC Ltd., affirming the legal principle that entities should not be penalized for procedural lapses beyond their control.

Bottom Line:

Sales Tax - Deduction claim - ST-15 forms rejected on grounds of theft and expired registration - Held, petitioner, a Government of India PSU, is not responsible for verifying genuineness of forms or certificates - Denial of benefit amounts to punishing the petitioner without fault - Petition allowed.

Statutory provision(s): Articles 226/227 of the Constitution of India, Haryana General Sales Tax Rules, 1975 Rule 21(2)

MMTC Ltd. v. State of Haryana, (Punjab And Haryana)(DB) : Law Finder Doc Id # 2816823