Court Directs Registrar to Register Sale Deed, Secured Creditors' Rights Prevail Over State Tax Claims

In a significant ruling, the Punjab and Haryana High Court has reaffirmed the precedence of secured creditors' rights over state dues under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act). The court directed the Sub-Registrar, Sub Tehsil Nighdu, Karnal, to register a sale deed in favor of the auction purchaser, M/s Mahadev Foods, following an e-auction conducted by the State Bank of India (SBI).

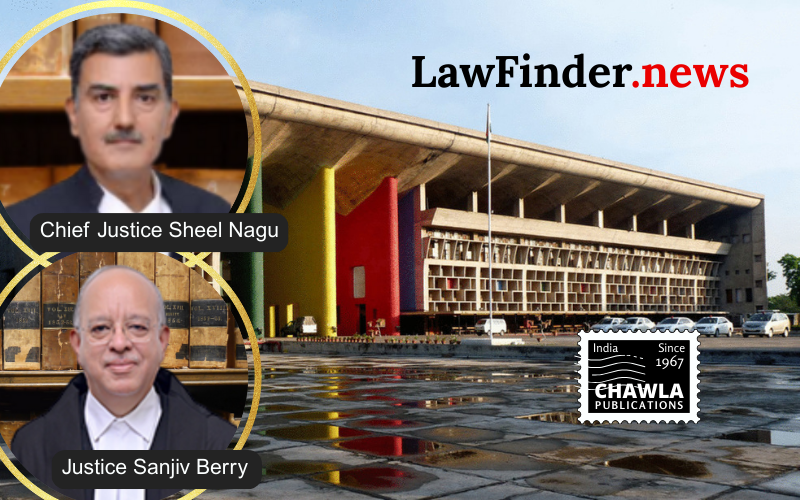

The judgment was delivered by a division bench consisting of Chief Justice Sheel Nagu and Justice Sanjiv Berry, in response to a petition filed by SBI. The bank was aggrieved by the Sub-Registrar's refusal to register the sale deed due to an attachment order for tax dues imposed by the State.

SBI had conducted an e-auction of secured assets to recover outstanding dues from M/s Mahavir Cereals, the borrower, who defaulted on a credit facility availed in 2013. The sale was completed in September 2021, but the registration was stalled due to state tax claims.

The court observed that the bank's charge over the secured assets was established in 2013, long before the state's attachment order in 2018. The court emphasized that, in the absence of a statutory first charge favoring the state, the secured creditor's rights under Section 26E of the SARFAESI Act take precedence.

The bench issued a writ of mandamus to the Sub-Registrar to proceed with the registration of the sale deed. Additionally, a writ of certiorari was issued to quash the prior charge recorded in the revenue records in favor of the state. However, the state was permitted to pursue the recovery of its dues after SBI's claims were satisfied.

The court also highlighted that revenue entries are merely administrative and do not override the statutory rights of secured creditors. The judgment aligns with established precedents set by the Supreme Court, affirming the priority of secured creditors over crown debts.

The court awarded costs of Rs. 25,000, to be paid by the State of Haryana, for delaying the liquidation of the secured asset. The decision underscores the legal framework supporting the rights of secured creditors in financial transactions.

Bottom Line:

Priority of secured creditor under SARFAESI Act prevails over other debts, including State dues, unless a statutory first charge is created in favor of the State.

Statutory provision(s): Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 - Section 26E, Constitution of India - Article 226/227