Supreme Court Clarifies Trust Registration Does Not Ensure Tax Exemption Section 12-AA Certification Alone Insufficient for Section 80-G Benefits, Supreme Court Rules

In a landmark decision, the Supreme Court of India has clarified that mere registration of a trust under Section 12-AA of the Income Tax Act, 1961, does not automatically entitle it to tax exemption benefits under Section 80-G. The judgment was delivered in the case of Commissioner of Income Tax, Exemption, Bhopal v. Sadhumargi Shantkranti Jain, where the apex court overturned the High Court's earlier decision.

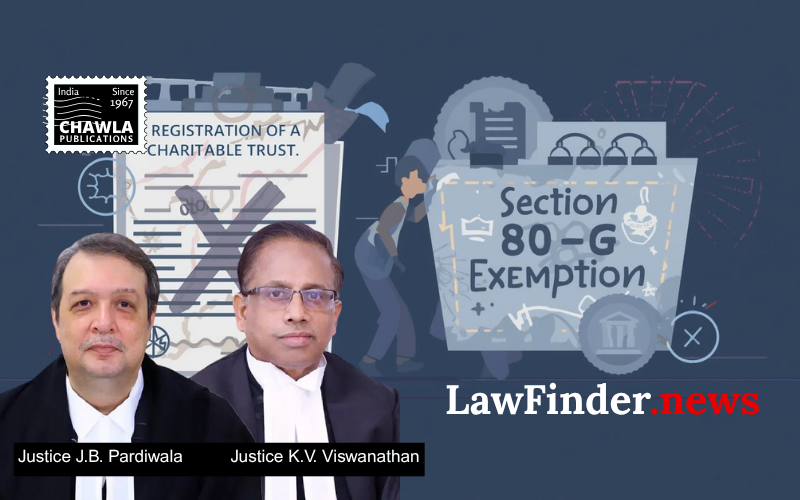

The Supreme Court's bench, comprising Justices J.B. Pardiwala and K.V. Viswanathan, addressed the specific issue of whether registration under Section 12-AA alone suffices for a trust to claim tax exemption under Section 80-G. The High Court had previously ruled that such registration was adequate for granting benefits under Section 80-G.

However, the Supreme Court emphasized that the issuance of a certificate under Section 12-AA does not automatically grant the trust the right to claim exemption under Section 80-G. The assessing authority is required to evaluate the nature of the trust's activities to determine if they are indeed charitable or religious.

The petition, filed by the Commissioner of Income Tax, Exemption, Bhopal, argued that the activities for which the exemption under Section 80-G was sought were predominantly religious rather than charitable, thus not qualifying for the exemption.

The court observed, "In a given case, the assessing authority may have to look into the nature of the transaction, whether it is charitable or religious." This decision underscores the need for a detailed examination of the nature of trust activities before tax exemptions are granted.

The Supreme Court has issued a notice, allowing a four-week period for responses, and permitted additional service of notice through Dasti.

This judgment has significant implications for trusts and charitable organizations, reiterating the need for stringent scrutiny of their activities to qualify for tax benefits. Legal experts suggest this decision may lead to a more rigorous assessment process by the tax authorities.

Bottom Line:

Registration of a Trust under Section 12-AA of the Income Tax Act, 1961 does not automatically entitle the Trust to claim exemption under Section 80-G of the Act. The assessing authority may need to evaluate whether the activities are charitable or religious in nature.

Statutory provision(s): Sections 12-AA, 80-G of the Income Tax Act, 1961