Court clarifies applicability of Section 80P(2)(d) and Section 80P(4) of Income Tax Act, 1961, in favor of non-banking cooperative societies.

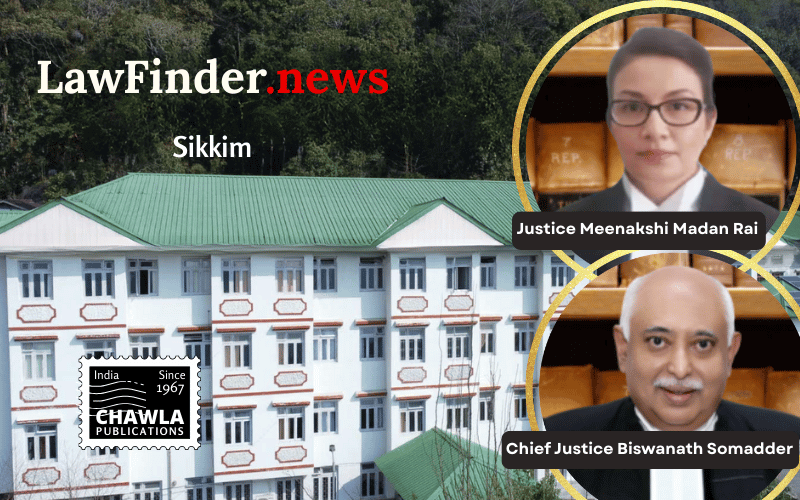

In a significant ruling, the Sikkim High Court has allowed the appeal of Sikkim State Cooperative Supply and Marketing Federation Limited (SIMFED), a non-banking cooperative society, granting them the benefit of income tax deduction under Section 80P(2)(d) of the Income Tax Act, 1961. The judgment, delivered on December 10, 2025, by the Division Bench comprising Chief Justice Mr. Biswanath Somadder and Justice Meenakshi Madan Rai, overturned the previous order of the Income Tax Appellate Tribunal, Kolkata, which had disallowed the deduction.

The case revolved around the interpretation of Section 80P(2)(d) and Section 80P(4) of the Income Tax Act, 1961. SIMFED, registered under the Sikkim Co-operative Societies Act, 1978, had claimed a deduction for interest income earned from investments made in cooperative banks. The Assessing Officer initially denied this deduction, which was later allowed by the Commissioner of Income Tax (Appeal). However, the Income Tax Appellate Tribunal reversed this decision, prompting SIMFED to appeal to the High Court.

The High Court clarified that Section 80P(4) specifically bars cooperative banks from claiming deductions on their own income but does not extend this restriction to other cooperative societies like SIMFED. The Bench emphasized that the statute distinguishes between cooperative banks and other cooperative entities, confirming that SIMFED qualifies for deductions on interest income derived from investments in cooperative banks.

Moreover, the Court addressed the applicability of the Supreme Court's judgment in Totgars' Cooperative Sale Society Ltd. case, which was previously cited by the Tribunal. The High Court noted that the facts of Totgars' case were materially different and not applicable to the present case, as the eligibility for deduction should be assessed under Section 80P(2)(d) and not Section 80P(2)(a)(i).

The Court also referenced the Gujarat High Court's decision in PCIT v. Ashwin Kumar Urban Co-operative Society Ltd., which supported the interpretation favoring SIMFED. With this ruling, the High Court has set aside the impugned order of the Income Tax Appellate Tribunal, allowing SIMFED to benefit from tax deductions on their interest income from cooperative banks.

This judgment is expected to have significant implications for non-banking cooperative societies across India, clarifying the scope of Section 80P deductions and providing a precedent for similar cases in the future.

Bottom Line:

Income Tax Act, 1961 - Deduction under section 80P(2)(d) - Interest income derived by a co-operative society from investments made in co-operative banks is eligible for deduction under section 80P(2)(d), as cooperative banks are treated as cooperative societies for the purpose of this provision. Section 80P(4) does not apply to disallow deduction under section 80P(2)(d).

Statutory provision(s): Income Tax Act, 1961 - Sections 80P(2)(d), 80P(4)