In a landmark decision, the Telangana High Court determined that income from tissue cultured plants qualifies as agricultural income, exempting it from taxation under the Income Tax Act, 1961.

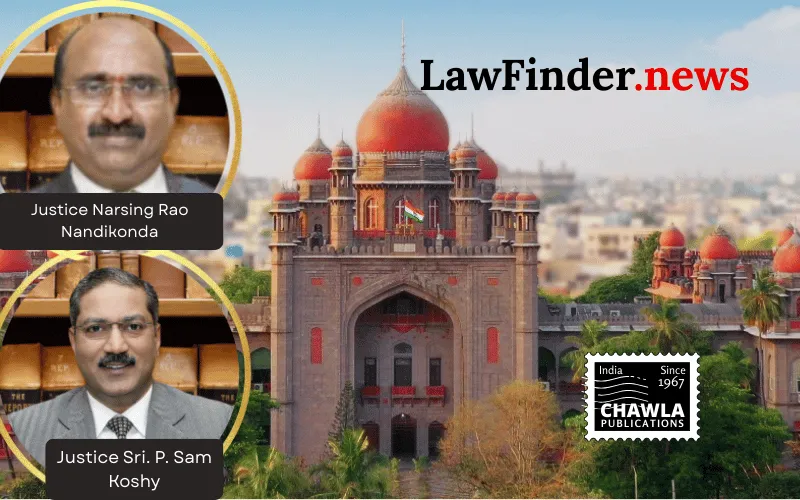

In a significant judgment delivered on November 21, 2025, the Telangana High Court ruled in favor of M/s. A.G. Biotech Laboratories (India) Ltd., holding that income derived from the sale of tissue cultured plants is classified as agricultural income and thus exempt from taxation under Section 10(1) of the Income Tax Act, 1961. The Division Bench, comprising Justice P. Sam Koshy and Justice Narsing Rao Nandikonda, set aside the previous order of the Income Tax Appellate Tribunal, which had categorized the income as business income.

The case revolved around the classification of income for the assessment years 2002-03 and 2003-04. A.G. Biotech Laboratories, engaged in the propagation of plants through tissue culture technology, argued that their income should be considered agricultural, as it involves cultivating mother plants on agricultural land and using advanced scientific methods for propagation.

The court emphasized that the essence of the company's activities remains rooted in agriculture. The Bench acknowledged that the cultivation of mother plants involves basic agricultural operations like tilling and planting, and that tissue culture is a modernization of traditional practices rather than a departure from agriculture.

The High Court's decision drew on precedents from the Madras High Court, Gujarat High Court, and the Supreme Court, which have recognized income from similar operations as agricultural. The court noted that the use of modern scientific techniques does not alter the agricultural nature of the operations.

This ruling provides clarity on the classification of income from modern agricultural technologies, reinforcing that such advancements do not negate the fundamental agricultural character of the income. The decision is expected to have significant implications for businesses in the biotechnology sector engaged in agricultural activities.

The court's judgment underscores the evolving nature of agriculture, acknowledging that technological advancements serve to enhance traditional agricultural practices. This decision is seen as a victory for biotechnology companies, providing them with a clear legal precedent for the tax treatment of income derived from tissue culture and similar technologies.

Bottom Line:

Income earned from the sale of tissue cultured plants qualifies as agricultural income and is exempt from taxation under Section 10(1) of the Income Tax Act, 1961.

Statutory provision(s): Income Tax Act, 1961 - Sections 2(1A), 10(1)