The High Court rules that Section 16(2)(c) of the CGST Act is constitutional, but protects bona fide purchasers from being penalized for suppliers' tax defaults.

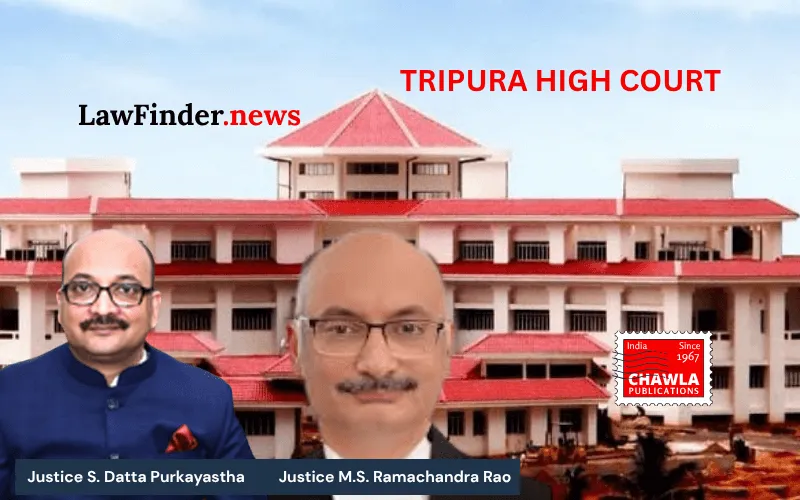

In a landmark decision, the Tripura High Court has ruled that Section 16(2)(c) of the Central Goods and Services Tax (CGST) Act, 2017, is constitutionally valid, while simultaneously clarifying its application to protect bona fide purchasers. The judgment, delivered by Chief Justice M.S. Ramachandra Rao and Justice S. Datta Purkayastha, emphasized the need to interpret the provision in a manner that does not penalize honest taxpayers for the defaults of their suppliers.

The case, M/S. Sahil Enterprises v. Union of India, revolved around the denial of Input Tax Credit (ITC) to M/S. Sahil Enterprises, a firm engaged in trading rubber products. The petitioner had been denied ITC amounting to Rs. 1,11,60,830 due to their supplier's failure to deposit the GST collected from them to the government. The Assistant Commissioner, Central Goods and Services Tax, had blocked the ITC and confirmed the demand along with interest and penalty.

The court addressed the constitutional challenge posed to Section 16(2)(c), which denies ITC if the tax has not been paid to the government. It was argued that such denial, in instances of genuine transactions, amounted to double taxation and violated Articles 14, 19(1)(g), and 300-A of the Constitution. The court found merit in the petitioner’s contention that honest purchasers should not be penalized for the supplier’s failure to remit the collected taxes to the government.

Relying on precedents from the Delhi High Court and the Supreme Court, the Tripura High Court read down the provision, asserting that it should be applied only in cases of non-bona fide, collusive, or fraudulent transactions. The court observed that expecting a purchasing dealer to ensure the supplier's compliance with tax payment was impractical and unjust.

The ruling mandates that Section 16(2)(c) should not be used to penalize bona fide purchasers who have fulfilled their tax obligations and paid GST to their suppliers. The court set aside the demand order against M/S. Sahil Enterprises and directed the authorities to restore the denied ITC.

The judgment highlights the court’s role in safeguarding taxpayers from unfair impositions and emphasizes the importance of interpreting tax laws in a manner that balances the interests of the state with those of honest taxpayers.

Bottom Line:

GST Law - Section 16(2)(c) of the Central Goods and Services Tax Act, 2017 should not be interpreted to deny Input Tax Credit (ITC) to purchasers in bona fide transactions, but it should be read down and applied only in cases of non-bona fide, collusive, or fraudulent transactions to defraud the revenue.

Statutory provision(s): Central Goods and Services Tax Act, 2017, Article 14, Article 19(1)(g), Article 265, Article 300-A, Section 16(2)(c), Section 73, Section 74.

M/S. Sahil Enterprises v. Union of India, (Tripura)(DB) : Law Finder Doc Id # 2833631