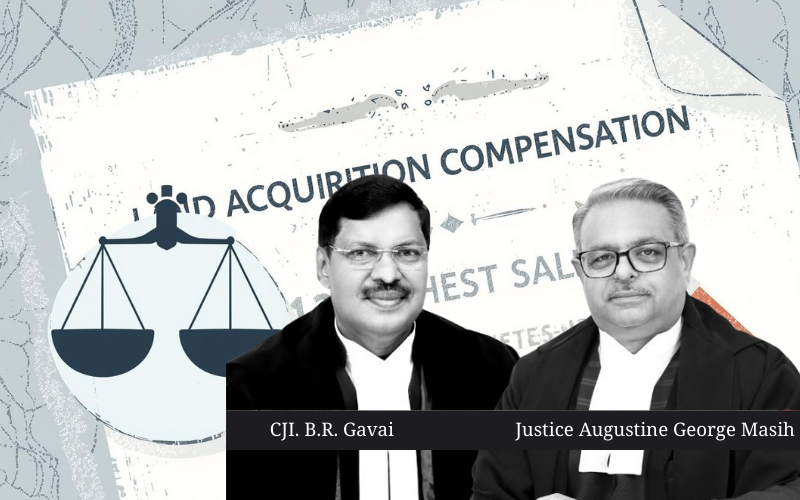

Supreme Court Enhances Compensation : Averaging sale prices is permissible only if variations are marginal - Deduction applied for larger area acquisitions.

The Supreme Court of India, in a recent landmark judgment, has significantly enhanced the compensation awarded to landowners in the case of Manohar and others v. State of Maharashtra. This decision underscores the importance of fair compensation in land acquisition cases and sets a precedent for future disputes. Let's delve into the key aspects of this judgment and its implications for landowners across India.

Background of the Case

The appellants, primarily farmers, owned substantial tracts of land in Parbhani, Maharashtra. These lands were acquired in the early 1990s under the Maharashtra Industrial Development Act, 1961, for the establishment of an industrial area. Initially, the compensation awarded was deemed inadequate by the landowners, prompting them to seek enhancement under Section 18 of the Land Acquisition Act, 1894.

Initial Proceedings and Appeals

The Reference Court, while partly allowing the appellants' reference, enhanced the compensation but not to the satisfaction of the landowners. The High Court subsequently dismissed their appeal, leading to the present batch of appeals before the Supreme Court.

Supreme Court’s Observations and Ruling

The Supreme Court's judgment critically analyzed the approach taken by the lower courts in determining compensation. Here are the key takeaways:

- 1. Highest Sale Exemplar Principle: The Court reiterated the principle that when several exemplars of land sales are available, the highest bona fide sale exemplar should be considered for compensation. The Reference Court's failure to consider the highest sale instance of Rs. 72,900 per acre was a critical oversight.

- 2. Rejection of Averaging Method: The judgment emphasized that averaging sale prices is only permissible when variations are marginal. In this case, the significant variation in exemplar prices rendered averaging inappropriate.

- 3. Deduction for Large Land Acquisitions: While the Court accepted the highest sale exemplar, it also acknowledged the need for deductions due to the larger area acquired. A 20% deduction was deemed appropriate, leading to an enhanced compensation of Rs. 58,320 per acre.

- 4. Legal Precedents: The judgment drew upon previous Supreme Court rulings, reinforcing the need for fair compensation reflective of true market value, especially in compulsory land acquisition scenarios.

- 5. Consequential Benefits: The Court also ensured that appellants receive all consequential benefits, including solatium and interest, as per Sections 23(1-A), 23(2), and 28 of the Land Acquisition Act, 1894.

Implications for Future Cases

This judgment is pivotal for landowners facing compulsory acquisition. It affirms the judiciary's commitment to ensuring just compensation reflective of market realities. By setting a clear precedent on the use of the highest sale exemplar and addressing the complexities of land valuation, the Supreme Court has provided a robust framework for future land acquisition cases.

For policymakers, this ruling is a reminder of the need for transparent and equitable compensation mechanisms in land acquisition laws. For legal practitioners, it underscores the importance of detailed evidence and strategic reliance on bona fide sale transactions in compensation disputes.

In conclusion, the Supreme Court’s decision in Manohar v. State of Maharashtra not only delivers justice to the appellants but also strengthens the legal landscape for land acquisition in India. As landowners and legal experts navigate future acquisitions, this judgment will undoubtedly serve as a guiding light.

Manohar v. State of Maharashtra, (SC) : Law Finder Doc Id # 2755500