Court Upholds Principles of Natural Justice, Invalidates Repeated Transfer Orders by Income Tax Authorities

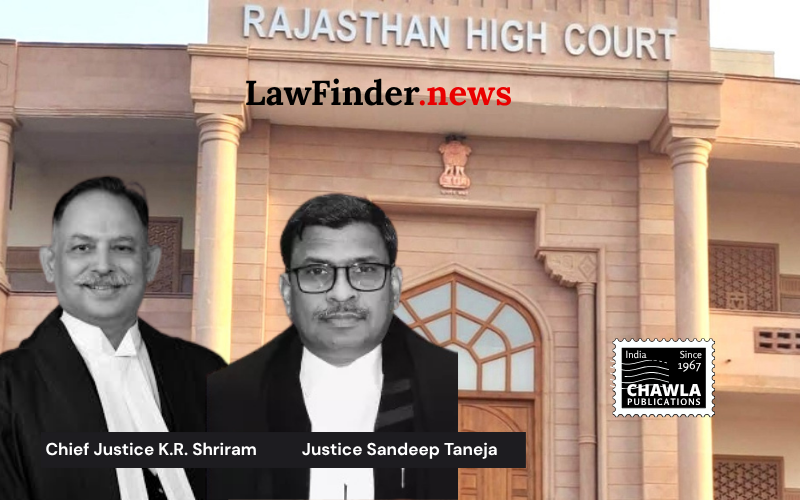

In a significant judgment, the Rajasthan High Court has quashed the transfer orders issued by the Income Tax Department concerning Murliwala Agrotech Pvt. Ltd., thereby reinforcing the principles of natural justice. The bench, comprising Chief Justice K.R. Shriram and Justice Ravi Chirania, ruled that the transfer of the case from Udaipur to Delhi was arbitrary and lacked a valid justification.

The case revolves around the Revenue Department's repeated attempts to transfer Murliwala Agrotech's tax assessment proceedings under Section 127(1) of the Income Tax Act, 1961. The court emphasized that any such transfer must adhere to the principles of natural justice, including providing a fair hearing to the assessee. The Revenue's failure to do so led to the quashing of the transfer orders dated 21.11.2019 and 19.10.2022.

The High Court highlighted the importance of maintaining transparency and fairness, particularly with the implementation of a faceless assessment system. Despite this system, the court found the Revenue's actions to be unreasonable and unjustifiable, indicating a lack of proper consideration for the principles of justice.

Citing previous decisions, including its own prior judgment dated 20.07.2022, the court noted that the Revenue had not presented any new circumstances to justify the repeated transfer orders. The court was critical of the Revenue's rigid stance, which prolonged the proceedings unnecessarily, causing undue hardship to the petitioner.

The bench allowed the Revenue to resume proceedings from the stage prior to the initial transfer order, provided they comply with legal protocols and offer a hearing to the petitioner. Additionally, while the court granted liberty to the Revenue to take action under Section 153C or other provisions, it cautioned against using this as a pretext for arbitrary decisions.

This judgment underscores the judiciary's role in ensuring that administrative actions align with legal and ethical standards, reinforcing the need for transparency and adherence to due process.

Bottom Line:

Income Tax Act, 1961 - Section 127(1) - Transfer of case - Adherence to principles of natural justice is mandatory before transferring the case from one assessing authority to another - Arbitrary and unreasonable actions by Revenue quashed.

Statutory provision(s): Income Tax Act, 1961 - Section 127(1), Section 153C

Murliwala Agrotech Pvt. Ltd. v. Union of India, (Rajasthan)(DB) : Law Finder Doc Id # 2789674